Part 4:Performance Management Systems: Designing Individual Goals Along with Identifying Organizational KPIs, Targets, and Results

By: KHA Consulting Team

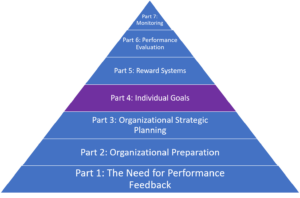

The following is part four of a seven-part series on Performance Management Systems. This blog series includes identifying the need for performance feedback, designing organization and individual employee goals, establishing incentivization programs, and communicating and monitoring the system

In our last installment we explored strategic planning for the organization through cohesion and macro and micro level strategy planning. In this installment, we will discuss developing individual goals, including the identification of key performance indicators, targets, and the respective result implications.

If you and your employees are asked to perform 2,000+ hours of work per year, should we not spend 5 of those hours on performance expectations, goal setting, and feedback? So many organizational leaders do not spend the time and later find themselves frustrated when there is a mismatch between organization expectations and actual employee performance. If you don’t provide this feedback, or if you try but your process fails, it is okay-we can help.

Connecting the Dots

The previous installments of this blog series (Part 1, Part 2, and Part 3), highlighted the need for employee performance measurement, feedback, and organizational strategy (including goals for both your organization and management). Now, we need to connect the organizational level directives to individual employee goals. If you are like most organizations, managers begin by delegating goal development to employees for ‘buy-in’, only to later realize those employee goals do not align with organizational needs.

With our clients, and at KHA with our own team of professional staff, we have taken the approach of co-designing goals. This allows for buy-in to be achieved along with ensuring those individual employee goals directionally align with the organization and will benefit all parties. If you approach this correctly, your organization goals will be aligned with individual employee goals setting the table to have both empowered and engaged employees who can visibly see the impact they make.

Roles not Individuals

The first step is to always design goals to the role, not the person. If you design the goals specifically to a person, they may not be achieved in the best interest of the organization. Yes, there is wisdom in growing individuals and setting achievable targets for those individuals in those roles; however, if an individual cannot meet the requirements of the role, it is unfair to lower the goals in hopes that there might be moral victories for the individual. Ultimately, a different consideration may need to be made as that individual may be in the wrong role within your organization. By designing goals for the role, you can also help the organization think longer term, especially in high turnover environments, or where a full-time equivalent is planned but not yet on board.

Tying Organization Goals to Roles

When designing goals for individual roles, we must consider what will make the organization successful, both in the short term as well as the long term. As we reviewed in prior installments (Part 1, Part 2, and Part 3), the organizational goals should be defined at this point, and if they are not, focus needs to be shifted to the organizational goals first. If we know what will make the organization successful, it only makes sense to identify who can influence those measures to provide the department and individual roles with specific goals related to those targets.

The following Harvard Business Review article discusses this thought process https://hbr.org/2011/02/making-sure-your-employees-suc. Our philosophy is to have some individual employee level goals along with some team goals where it makes sense. Truly, the team must work together to find the impact they need to make for the organization to be successful.

Key Performance Indicators

In order to measure performance, a metric must be identified that is both measurable and controllable by those responsible within a given position, as well as, feasibly understood. Depending upon the role within your organization, specific duties may be required. As a result, specific objectives will be set out for each of the positions. In order to generate employee and manager focus, 2 to 4 key performance indicators (KPIs) should be used per position or role per measurement period. Anything more can create confusion and overwhelm the position holder when goals are later reviewed. Once the KPIs are established for the individual role, KPI measurement is then defined. This KPI measure is key to understanding what performance targets will be later measured by management and how it will be measured. It is not a good idea to create a cumbersome amount of work to measure each KPI as it distracts from the actual work product and goal. Those key KPIs should be readily available in management systems and reporting. If they are not, we need to ask a different question about organization infrastructure, such as, “If these measurables are this critical, why do we not have their reporting information readily available?”

Clarify, Clarify, Clarify

Do not underestimate the value of making goals and the related KPIs abundantly clear so that the measures and metrics used by the team and individual employees reflect results, good or bad. This process is iterative. Communication must be done across each level within your organization on multiple occasions to allow for reinforced clarity on what each measure can and cannot do for the organization.

In our next installment, we will review options for incentivization through organization, department, and individual level measurements and rewards.

At KHA Management Consultants, we work with organizations of all sizes and shapes to identify what makes the organization, its stakeholders, and its employees tick. We facilitate the performance management process with your organization’s key constituents to ensure buy-in, ownership, and a new way of thinking about the organization and its stakeholders among all levels of employment. From a resource perspective, we primarily use our unmatched experience but also tap into the top-level resources such as those provided by Harvard Business Review and MentorPlus. Some of those materials, frameworks, and lessons have been used in writing this blog.

KHA Management Consultants, the consulting department of KHA Accountants, PLLC, based in Flower Mound, Texas, is always looking for opportunities to work with key clients ready to take their business to the next level. If you have a desire to improve, take the first step toward success with the performance management experts, and contact us at 972-221-2500.