ARTICLE | May 27, 2023

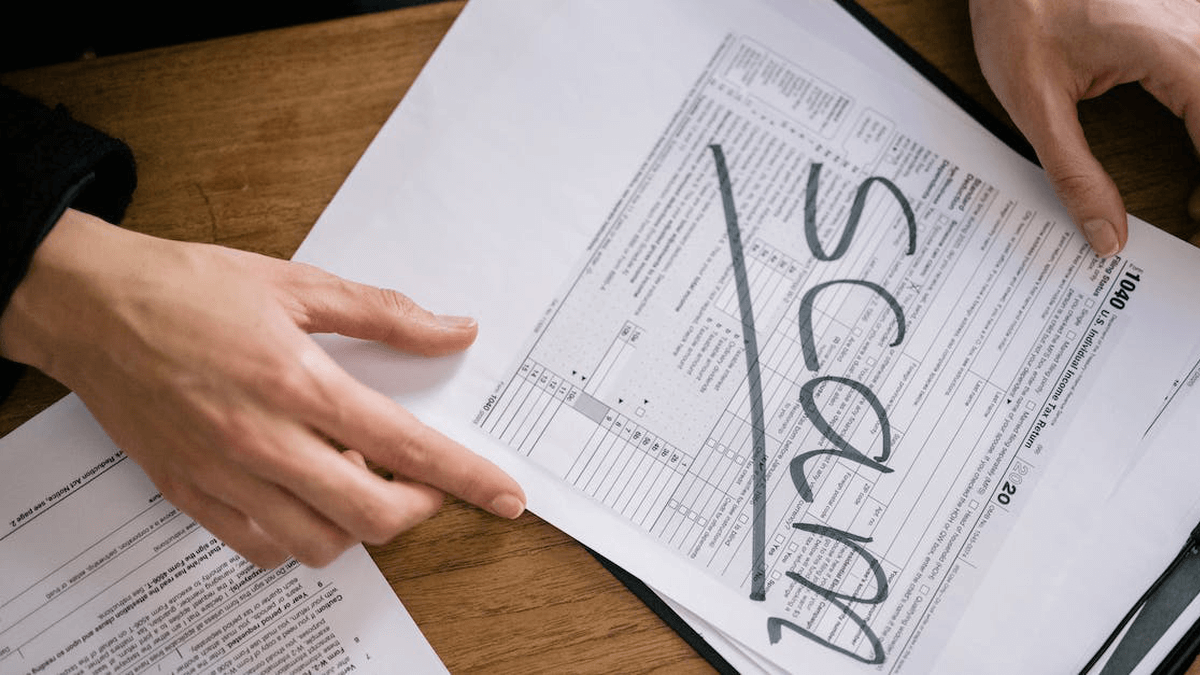

The IRS has issued a warning to businesses and tax-exempt organizations about the prevalence of misleading employee retention scams. These scams involve fraudulent claims for tax credits related to the COVID-19 pandemic. The IRS highlights several warning signs that businesses should be aware of such as promises of expedited processing and requests for payment upfront.

To avoid falling victim to these scams, the IRS recommends that businesses and tax-exempt groups only work with trusted tax professionals and carefully review any offers or claims related to COVID-19 tax credits or refunds. It is also important to keep accurate records and only provide sensitive information through secure channels.

As a public accounting firm, we urge our clients to be vigilant and cautious when it comes to these types of scams. By taking simple steps to protect yourself and your organization, you can avoid the risks of improperly filing claims and potentially facing penalties or legal consequences.

Read the IRS news release here: IRS Article

Questions or Want to Talk?

Call us directly at 972.221.2500 (Flower Mound) or 940.591.9300 (Denton),

or complete the form below and we’ll contact you to discuss your specific situation.