Part 1:Performance Management Systems: The Need for Performance Feedback

By: KHA Consulting Team

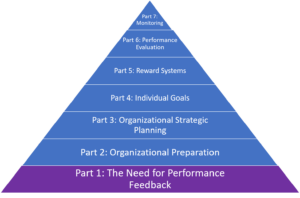

The following is part four of a seven-part series on Performance Management Systems. This blog series includes identifying the need for performance feedback, designing organization and individual employee goals, establishing incentivization programs, and communicating and monitoring the system

Does your organization feel like it is just moving with unclear direction, or worse, going in multiple directions? Do you find yourself frustrated with the lack of employee ownership of organizational issues? Do your employees know how they are performing and what steps they should take to further improve?

Welcome to the first installment of a new series on performance management where we will explore the ins and outs of establishing a program that will provide clarity, accountability, and alignment. This program must consider the goals of the organization, departments, and its employees.

Employees Need to Know

Many times, employees do not know where they stand, what their specific purpose is in the organization, or where the organization is heading. Managers often believe they have communicated employee performance expectations and results, whether positive or negative, but often there is a large gap that leads to confusion in the workplace. Managers may also believe that the organization strategy and its policies have been communicated to employees, however, managers themselves may be unaware of the organization strategy and may not be providing the correct message to their teams. The following Harvard Business Review article showcases how employee feedback is a primary means to helping employees reach their potential in your organization (https://hbr.org/2016/10/give-your-team-more-effective-positive-feedback). This seven-part blog series will tackle these management issues while reviewing how your team can be realigned, united around the organization mission, with increased employee satisfaction and production.

No Substitutes for Management Involvement

There is not an outsourced solution for quality feedback given by an employee’s direct manager. This takes time and yes, it will even take time away from other critical things in the organization, but there is not anything more critical than employee feedback. Many times, KHA is effectively told: “I want my employees to improve, however, I constantly fight the same fires, dance around providing honest feedback, and never sit down to address the elephant(s) in the room.” We have found that if managers would spend five hours per employee per year providing performance feedback and communication regarding the organization, there would be significant time savings for both the organization and its employees.

This time investment is hardly ever ill received by employees. In today’s organizations, there is too much guesswork, much of which can be avoided. Distinguished organizations, example: Apple, Google, etc., are getting to a place where employees understand the organization, the department they work in, along with their individual goals and roles. Communication of employee concerns informs management so that there is a continual learning loop and sharpening of the organization along the way.

Obtaining Buy-in

For any good system to work, there must also be buy-in at all levels within the organization. In this case, we need employee survey feedback too. What is the employee survey feedback? There is nothing better than employee surveys for honest, gut-wrenching feedback on how management and the organization is faring. And, it’s needed per a recent Harvard Business Review article, (https://hbr.org/2018/03/employee-surveys-are-still-one-of-the-best-ways-to-measure-engagement). This article highlights the fact that employee surveys are still key to measuring employee engagement. The data collected in these surveys is unbelievably valuable; if you want to improve your organization, you must find a way to admit and agree upon some of the things that are felt in the organization by employees and design plans to move beyond those issues. Ultimately, your organization’s ownership is open to everyone because all employees must own the organization mission, vision, and values if there is going to be long-term sustainability.

In our next installment, we will explore setting the table for the development of your organizational plan through a strategy primer, setting priority, and reviewing current policy.

At KHA Management Consultants, we work with organizations of all sizes and shapes to identify what makes the organization, its stakeholders, and its employees tick. We facilitate the performance management process with your organization’s key constituents to ensure buy-in, ownership, and a new way of thinking about the organization and its stakeholders among all levels of employment. From a resource perspective, we primarily use our unmatched experience but also tap into the top-level resources such as those provided by Harvard Business Review and MentorPlus. Some of those materials, frameworks, and lessons have been used in writing this blog.

KHA Management Consultants, the consulting department of KHA Accountants, PLLC, based in Flower Mound, Texas, is always looking for opportunities to work with key clients ready to take their business to the next level. If you have a desire to improve, take the first step toward success with the performance management experts, and contact us at 972-221-2500.