Part 2:Performance Management Systems: Setting the Table

By: KHA Consulting Team

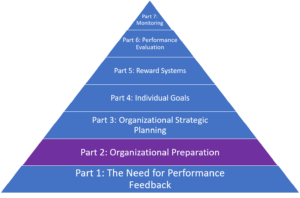

The following is part four of a seven-part series on Performance Management Systems. This blog series includes identifying the need for performance feedback, designing organization and individual employee goals, establishing incentivization programs, and communicating and monitoring the system

Do your employees know where the organization is headed? Do you, organization leadership, know where the organization is headed?

In our last installment linked here The Need for Performance Feedback, we discussed the need for performance management and measurement systems. As part of the process, we discussed employees needing to know where they stand, that there were no substitutes for management involvement, and obtaining buy-in across all levels. In this installment, we will explore setting the table for the development of your organizational plan through a strategy primer, setting priority, and reviewing current policy.

A Strategy Test

If you think you know where the organization is headed, conduct an internal survey and ask three simple questions of everyone taking the survey:

- What are the mission, values, and vision of the organization? (No research allowed)

- What key measures of success do you think the organization should use to understand and identify progress, or lack thereof?

- How many employees will it take for us to fulfill our vision in the next 5 years?

If you have alignment on these three questions across a surveyed group of 6-10 employees representing all levels of the organization, without doing any serious strategy and organization messaging prior to asking, please send a copy to the National Archives and forward me a copy. Aligning your group of employees takes work; the yield will certainly outweigh the toil, but this process does not just happen overnight. Organization alignment is most critical and there is not a magic bullet that will suddenly align the organization and its employees.

Organization Comes First

Strategic Planning is critical and comes before individual employee performance metrics, targets, goals, etc. In order to set these individual employee goals, we must know what the organization’s direction, strategy, and future are. Management must walk through the formalized strategic planning process to establish the groundwork for the future of the organization. Through strategic planning, cohesion, and clarity a course can be found and set. See the prior blog series on strategic planning for further information Strategic Planning. Also, the next installment will briefly cover organizational strategic planning.

Review Current Policy

With the table almost set to start the employee performance review process, KHA will work with your management team to review your current policy and to set the parameters around the proposed performance management system. As unpopular as organization policy and procedures may be, this system will clarify for everyone the rules and expectations, define what is at stake, and explain the consequences of both positive and negative employee reviews.

Kickoff With KHA

We begin your performance management system process by conducting workshops with key management personnel within your organization. This meeting sets the tone for your process revamp and provides context for current organization issues that must be addressed if employee performance improvement is hoped for. These onsite sessions are tailored to your organization depending on the nature, scope, and employee issues that are currently being experienced in the organization. The hoped-for outcome is two-fold; 1. we need feedback and context from your management team, 2. we also need alignment across your management team and employees. This task is a lot to ask of your team. It will have positive results across your organization but not without change. The Harvard Business Review published a great article on how to communicate change within your organization: https://hbr.org/2018/08/how-to-tell-your-team-that-organizational-change-is-coming.

In our next installment, we will explore strategic planning for the organization through cohesion and macro and micro level strategy planning.

At KHA Management Consultants, we work with organizations of all sizes and shapes to identify what makes the organization, its stakeholders, and its employees tick. We facilitate the performance management process with your organization’s key constituents to ensure buy-in, ownership, and a new way of thinking about the organization and its stakeholders among all levels of employment. From a resource perspective, we primarily use our unmatched experience but also tap into the top-level resources such as those provided by Harvard Business Review and MentorPlus. Some of those materials, frameworks, and lessons have been used in writing this blog.

KHA Management Consultants, the consulting department of KHA Accountants, PLLC, based in Flower Mound, Texas, is always looking for opportunities to work with key clients ready to take their business to the next level. If you have a desire to improve, take the first step toward success with the performance management experts, and contact us at 972-221-2500.