Part 5: Performance Management Systems: Designing Your Employee Compensation Plan and Profit-sharing Bonus Plan

By: KHA Consulting Team

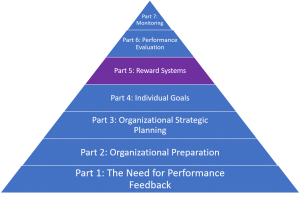

The following is part five of a seven-part series on Performance Management Systems. This blog series includes identifying the need for performance feedback, designing organization and individual employee goals, establishing incentivization programs, and communicating and monitoring the system.

In our last installment, we discussed developing individual goals, including the identification of key performance indicators, targets, and the respective result implications. In this installment, we will review some options for incentivization through organization, department, and individual level measurements and rewards.

Your organization and leadership team may set goals and monitor employee performance, but what if you cannot get employees motivated to move on those targets? Likely, you do not have incentives setup to promote the employee experience and encourage employee ownership of strategic areas of the business. We are not talking just money here. What gets measured gets done, what gets rewarded gets done again, and again, and again.

Profit Sharing Bonus Plan

There are many ways to structure such incentivization programs both from a functional and mechanical perspective. Some plans occur just at the organizational level while others come with the possibility of tax advantages. Some plans take a percentage of net profits and create a bonus pool, insulating owners in down years but sharing the upside in good years. Our scope in this blog will not be getting into those minute details. As the need arises, we would love to discuss the potential cash flow and tax implications and opportunities that might exist when you build your program.

In this blog, we will go into the basics of incentivization programs. When designing a profit sharing or bonus plan, there are three layers to discuss: Organization or organizational, departmental, and individual levels.

Layer 1: Organization Level Requirements

If your role is manning the sail on a sailboat, and the sail is up and flying but the ship is sinking, would you focus on how good a job you are doing individually, or would you help your compadres bail as much water out of the boat as possible to keep it afloat?

For there to be profits to share or cash flow to fund bonuses, the organization itself must do well. Afterall, the reason this whole process interests (or should interest) owners is because they know engaged employees can be a competitive advantage. Engaged employees can lead to more profit, which can and should be shared across the organization. Harvard Business Review recently published the following article on how organizations should not spend money trying to get employee engagement: https://hbr.org/2017/03/why-the-millions-we-spend-on-employee-engagement-buy-us-so-little. The organization’s focus must be long term in nature; we cannot just measure to a number, instead, a holistic approach for the entire organization must be taken. KHA Management Consultants has dealt with organizations before that have had unbelievably successful years in one department (the sail team) only to watch another department really struggle (any other role on the ship). At the end of the day, this organization was flat or much worse, negative. This first layer is unbelievably critical to reorienting the thought process around how the team should work together, and, that unless the organization succeeds, no one succeeds.

Layer 2: Departmental Level Requirements

Similar to organization level requirements, departmental level requirements can also be set or established. These departmental goals help to align micro-teams within the organization to work together. Many times, these departmental goals follow the organizational structure or chart, however, sometimes they may not. This happens in the case of specific cross-department teams that carry a critical task for the organization at large. For example: a credit approval process that involves sales, accounting, and compliance. Depending on how departmental and organizational leaders want to handle these cross-department goals, it may be a good place to give decision making authority to the department heads on what thresholds triggers should be used. A caution: watch out for those managers with extreme expectations or those managers with lax expectations. In the first scenario, people do not feel like they are accomplishing anything winding up defeated and in the second scenario, the bars are too low for anyone to have to exert real effort.

Layer 3: Individual Level Requirements

Now that layers 1 and 2 have been discussed and fleshed out, let’s talk about the individual employee level requirements to trigger bonus funds. Based on organization and departmental performance, generally, monetary pools are created. These pools do not necessitate bonuses or profit sharing, they just create the available amount under consideration. In order for these pools to be tapped, individual level performance is required to be met or exceeded. Going to our previous installment on strategic planning, we have 2-4 key performance indicators per role for which we need to set targets for achievement. These targets need to be realistic, reachable, and scalable. Meaning, the targets can be achieved within a reasonable amount of exerted, and even extra, effort. At the same time, the rewards get bigger with better performance.

A Note on Tracking and Monitoring

I want to leave you with one final takeaway regarding tracking and monitoring. To make this performance review process work, the agreed upon KPIs must be measurable, updated at least quarterly (KHA recommends monthly), and clearly understood from a results perspective. If the performance review process will take more than one full-time equivalent employee to monitor all of the organization’s KPIs, some of the KPIs/measures may be too burdensome or the organization systems may not be in line with what is needed to really manage the business.

In the next installment, we will discuss the performance evaluation form and process.

At KHA Management Consultants, we work with organizations of all sizes and shapes to identify what makes the organization, its stakeholders, and its employees tick. We facilitate the performance management process with your organization’s key constituents to ensure buy-in, ownership, and a new way of thinking about the organization and its stakeholders among all levels of employment. From a resource perspective, we primarily use our unmatched experience but also tap into the top-level resources such as those provided by Harvard Business Review and MentorPlus. Some of those materials, frameworks, and lessons have been used in writing this blog.

KHA Management Consultants, the consulting department of KHA Accountants, PLLC, based in Flower Mound, Texas, is always looking for opportunities to work with key clients ready to take their business to the next level. If you have a desire to improve, take the first step toward success with the performance management experts, and contact us at 972-221-2500.