ARTICLE | November 05, 2024

November 2024, Volume 1, Issue 8

Bake’s Takes: A KHA Recommended Reads by Jonny Baker, Partner at KHA.

Hot Take: “Reading furnishes the mind only with materials of knowledge; it is thinking that makes what we read ours.” ? John Locke

As a leader you need exposure to varying perspectives, insights, and ideas.

This month’s Top 3:

1. How High Achievers Overcome Their Anxiety, Aarons-Mele

- This one hit home for me. The author gives praise to those high achievers out there, you know who you are, but also talks about the dark side of such unrelenting drive.

- Aarons-Mele covers 11 distinct through traps: all-or-nothing thinking, labeling, jumping to conclusions, catastrophizing, filtering, discounting the positive, “should” statements, social comparison, personalization and blaming, ruminating, and emotional reasoning.

- The author then covers six ways to dodge the traps: make the anxiety an ally, practice self-compassion, see the humor, get physical, try guided meditation, and just say no.

2. Teamwork at the Top, LeStage, Nilsson DeHanas, Gerend

- Article was just published in the recent September-October 2024 issue and overviews the five traits of effective top teams: Direction, Discipline, Drive, Dynamism, and Collaboration.

- Teams wanting to improve are encouraged to take four steps: commit and invest, hold up the mirror, map the journey and begin, and maintain momentum.

- The keys to creating teamwork at the top: getting together, building habits, remaining opportunistic, becoming adaptable, making teaming real and applicable, reinforcing what is needed, measuring what matters, and communicating through different forums and often.

3. Why Leadership Teams Fail, Keil and Zangrillo

- The article was also in the September-October 2024 HBR issue and highlights research as to why leadership teams do not make the cut.

- The authors speak of three types of leadership teams: Shark tanks (where leaders are prone to infighting and acting distributive towards one another and business issues), petting zoos (where leaders are more concerned with getting along than doing the right thing at the right time in the right context), and mediocrity (a team that has learned to accept mediocre results, having lost its hunger and drive).

- For what it’s worth, most of the teams I work with are either shark tanks or mediocracies when I arrive, and we push them towards a sting ray touch tank where there is healthy collaboration, we stay within the bounds of the tank, but we can move swift when needed. This is the ground between the shark tank and the petting zoo; tank some, pet some, mediocracy no.

- The article then gives practical advice of how to reverse course and overviews how to take the shark tank to a team of stars, petting zoos to synergistic team, and mediocracy to high performers.

- Finally, the authors highlight the critical four steps to high performing teams: develop a clear vision and purpose, focus on alignment, outline responsibilities, and establish behavioral norms.

- KHA’s vision, alignment, and execution process does just that for leadership teams.

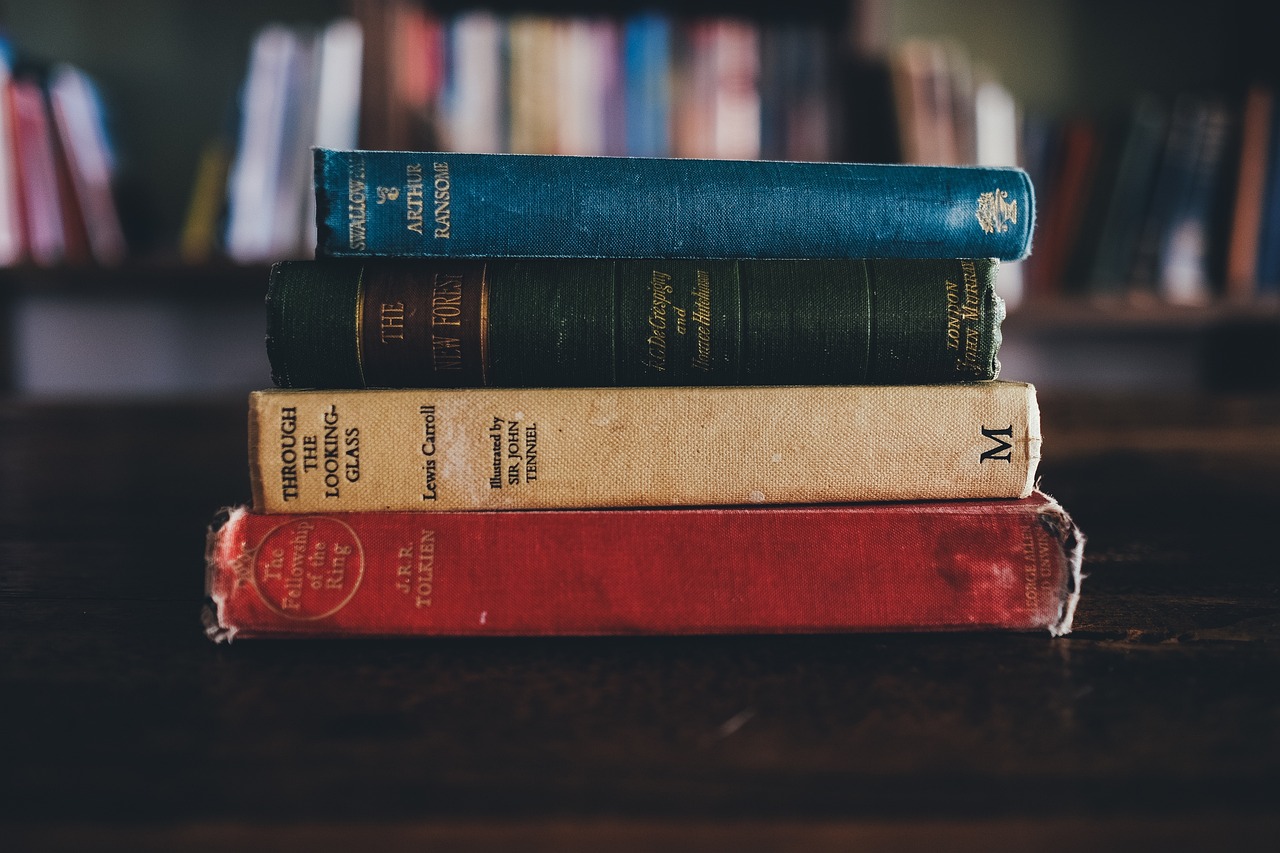

Why Bake’s Takes: I have been accused by friends, colleagues, and clients of pelting people with articles and book recommendations. Some of my mentees have stacks of books they will never get through (some of my mentors too). As such, I have decided to curate a monthly summary that holds what I deem to be the 3 best articles or reads of the month (when I read them, not published that month). I do love Harvard Business Review and you will see much of it as my work is focused on equipping leaders for the tough tasks ahead of creating vision, alignment, and execution. I have yet to find a better resource for equipping that work well.