Insights

Not everything in the accounting and financial world is black and white. Much is left to interpretation coupled with experience. At KHA, we know our clients value our perspective and guidance. We therefore not only see it as our duty to share regulatory updates, but also our commitment to share our insights on matters that impact you, our clients.

Topic

Maximizing the expanded QSBS benefit while avoiding missteps.

A family office could be the vehicle you need to take your tax, wealth, and legacy goals to the next level. Find out if a streamlined structure is right for you.

Estate planning goes beyond a simple will; it's about preserving your legacy and ensuring your intentions are honored. This article explores how trusts can help minimize probate, protect privacy, and expedite asset distribution. Learn strategic steps to create a robust estate plan that benefits future generations while addressing potential tax implications.

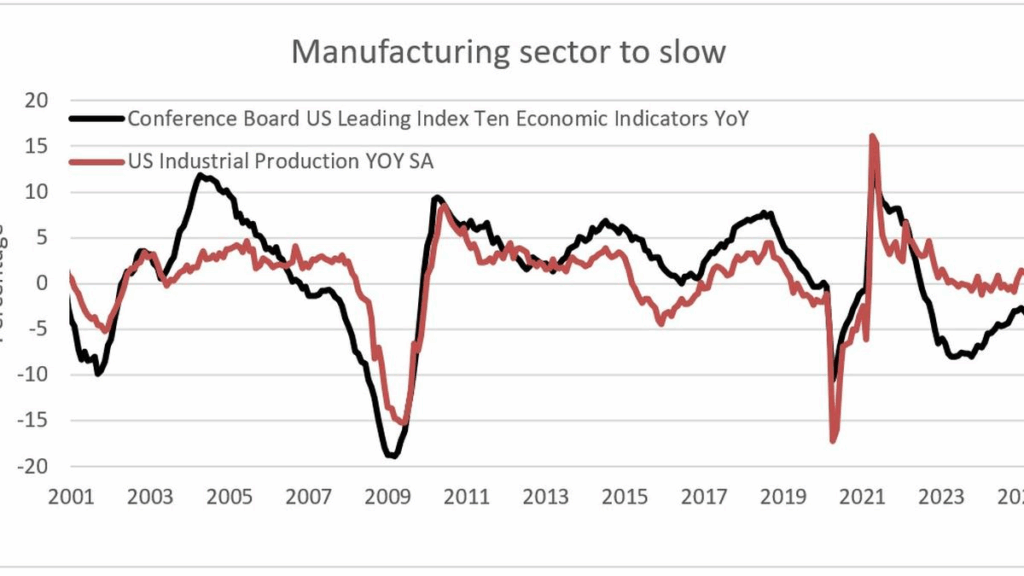

The Conference Board's Leading Economic Index implies that the broader manufacturing sector will slow into the second half of the year.

Discover practical strategies to streamline your front office, leverage digital tools, and offer flexible payment options that elevate patient satisfaction and accelerate cash flow. This concise guide shows dental practices how to boost efficiency and profitability without sacrificing the quality of care.

Every stage of the business lifecycle comes with hidden financial risks—and most aren’t where you’d expect them. From early cash flow traps to overlooked succession planning, it’s easy to miss the warning signs until they’ve already impacted your bottom line. In this video, we break down the most common blind spots—and how to stay ahead of them.

This article discusses the permanent QBI deduction and also minor changes found in the OBBBA.

If your business is investing in research and experimentation (R&E), you could be leaving money on the table. Recent updates to tax policy offer expanded relief for companies driving innovation—whether you're developing new products, improving processes, or exploring emerging technologies. Learn how to leverage these incentives to reduce your tax burden and reinvest in what matters most: growth and discovery.

RSM explains how the Big Beautiful Bill restores and expands 100% bonus depreciation and how it incentivizes capital investment. Learn more.

The One Big Beautiful Bill introduces significant changes to state and local tax practices and policies and other provisions.

Economic upheaval doesn’t just bring challenges - it opens the door for businesses that are willing to adapt. Now is the time to rethink your operations and uncover new opportunities for growth.

Has your business outgrown basic bookkeeping? If you’re facing bigger decisions, more complexity, or uncertainty about your financial future, it may be time to consider whether you need more strategic financial support than a bookkeeper can provide.

When relatives lend or gift money, it can strengthen family bonds or lead to complications if not handled properly. This video explores the differences between gifts and loans in family finances, highlighting IRS guidelines and offering strategies to manage these transactions with minimal tax impact.

Uncover common estate planning mistakes that could jeopardize your assets and learn how to avoid them. Find out why aligning beneficiary designations with your will or trust is vital and discover the benefits of setting up a trust to manage your assets effectively.

Find out how to stay financially prepared for any situation with six essential steps, from building an emergency fund to estate, tax, and investment planning.

No results found.