Insights

Not everything in the accounting and financial world is black and white. Much is left to interpretation coupled with experience. At KHA, we know our clients value our perspective and guidance. We therefore not only see it as our duty to share regulatory updates, but also our commitment to share our insights on matters that impact you, our clients.

Topic

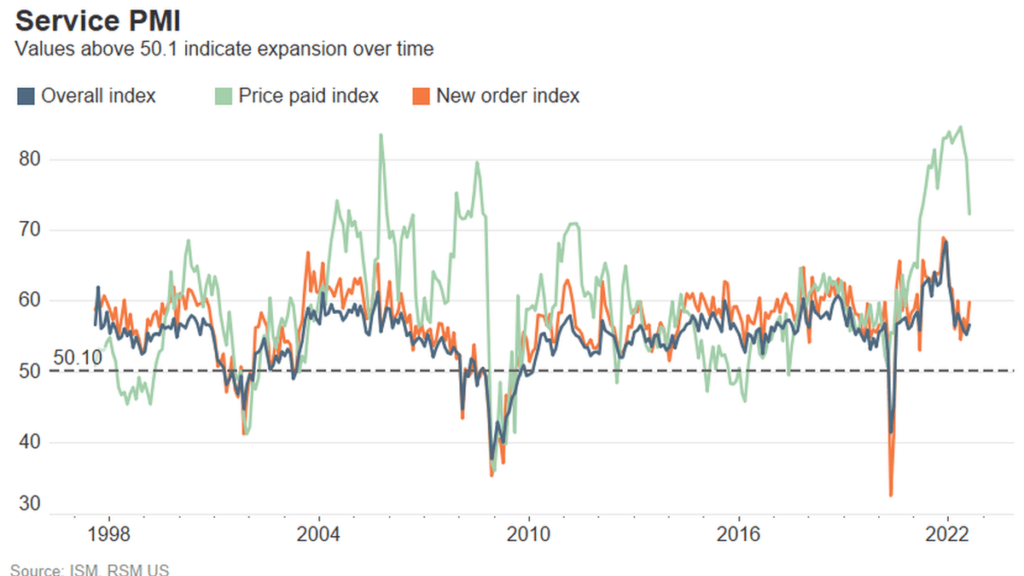

The service sector grew faster than expected in July on the back of broad-based increasing business activities and new orders.

The IRS lays out six categories of expenditure to which interest can be traced. How the funds are used will determine the type of interest deductible.

This article examines the various federal income tax issues, both from the individual and entity level, to be mindful when an owner of a passthrough entity dies.

Tax planning strategies can help businesses experiencing higher interest expense due to inflation, increased interest rates and lower tax deductions.

For many teenagers, summer often means a time for sports camps, swimming in the pool, and working a summer job. For many parents, this means dealing with the tax implications of their child’s income. In this article, we'll provide an overview of what tax filings may be required for your working teenager.

Pass-through entity elections are creating tax planning complexity. This article explains what you need to know and what you should do next.

A number of states begin to consider or take steps related to the state taxation of digital assets as the economy for these assets continues to grow.

The recent reopening of China’s factory floors and the easing of its supply chain bottlenecks have prompted discussion about the ability of the U.S.

Many wealthy individuals have taken steps to maximize their lifetime gift tax exemption before it reverts back to a lower level in 2026. However, the IRS recently proposed new guidance that would allow for clawbacks of certain gifted assets. Learn more about the proposed changes in this article.

The IRS provides some relief amid rising gas prices with an optional increase to the standard mileage rate for business travel.

How will the new Form 7203, S Corporation Shareholder Stock and Debt Basis Limitations, impact tax filings for family offices and other taxpayers?

RSM took a detailed look at gross margins across different peer groups in the industrials sector to see how each has fared during this time of high inflation.

The IRS recently released new contribution limits for 2023 health savings accounts and excepted benefit health reimbursement arrangements and new requirements for qualifying high deductible health plans to reflect cost of living adjustments. Learn about the new limits and requirements in this article.

The manufacturing sector expanded at the slightly faster rate in May as demand remained strong.

In February of 2022, the IRS and Treasury released proposed regulations that provide updated guidance for the SECURE Act of 2019, including significant changes for beneficiaries of inherited IRAs and 401(k) plans.