Insights

Not everything in the accounting and financial world is black and white. Much is left to interpretation coupled with experience. At KHA, we know our clients value our perspective and guidance. We therefore not only see it as our duty to share regulatory updates, but also our commitment to share our insights on matters that impact you, our clients.

Topic

In this month’s Bake’s Takes, Jonny Baker explores the shift in leadership dynamics and the value of unleashing employee creativity. Baker discusses the need for a daring, contrarian mindset for breakthroughs and the power of asking the right questions. Gain insights from his top three recommended reads to navigate the complexities of change and strategic management.

Ever felt like finding a solution to your business problem is like finding a needle in a haystack? Just as a needle is found by stepping back from the haystack, let KHA Strategic Consultants give you the outside perspective to find your answers. Contact us today for an objective assessment of your business and a proven path to success.

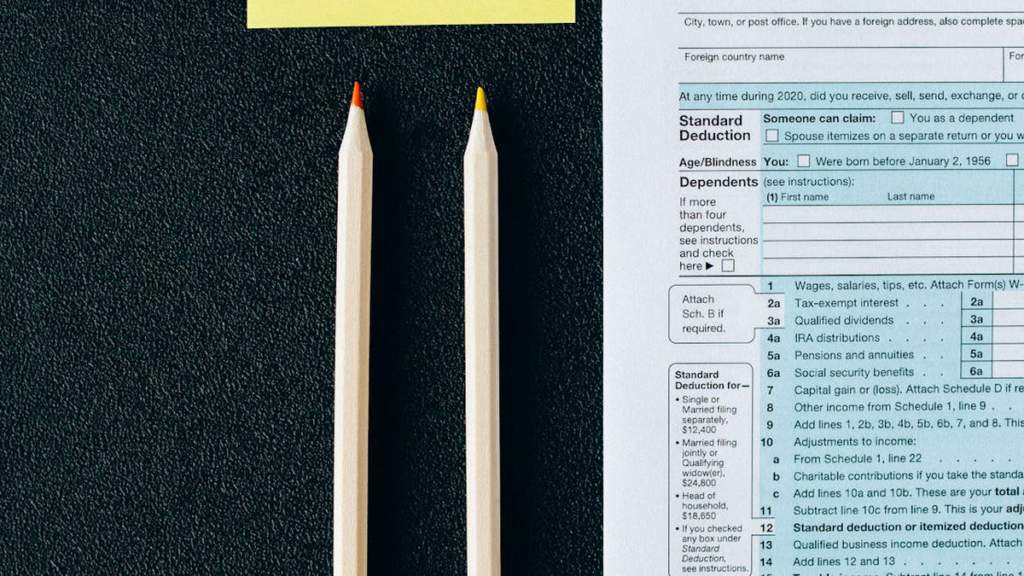

Explore the tax implications of debt cancellation across different entities with our introductory guide on CODI.

Explore the three key factors contributing to the isolation often felt by CEOs and business leaders. Learn how our Dynamic Business Advisory service can provide the necessary context and expertise to help you navigate complex business decisions.

Dive into Bake’s Takes, a monthly roundup of the best leadership reads, curated by Strategic Consulting Partner, Jonny Baker. This edition explores decision-making dynamics, coaching strategies for rookies and veterans, and the journey to authentic leadership. Join us to equip yourself with insights from Jonny Baker, fostering vision, alignment, and execution in your leadership role.

House Ways & Means Committee Chairman Jason Smith (R-MO) and House Tax Subcommittee Chairman Mike Kelly (R-PA) recently announced the formation of 10 "Committee Tax Teams". Each team will address key tax provisions from the 2017 Tax Cuts and Jobs Act (TCJA) that are set to expire in 2025 and identify legislative solutions.

KHA Consulting leader Jonny Baker offers a monthly recommended reading list.

Profits interest are an equity-based compensation device intended to incentivize key employees in partnerships.

As we navigate the complexities of financial planning, one opportunity stands out for young adults: individual retirement accounts (IRAs). With the 2023 tax-year contributions deadline fast approaching on April 15, 2024, now is the perfect time to consider how you can leverage an IRA.

If you invest or trade in Bitcoin, non-fungible tokens (NFTs), Stablecoins, or other digital assets, prepare for sweeping new tax reporting requirements. Congress wants the IRS to crack down on taxpayers who buy and sell crypto but don’t report or pay tax on their gains.

The December 2023 revision of Form 8283 includes new reporting for digital assets, certified historic structures and passthrough entity information.

IRS urges employers to review ERC claims before the Voluntary Disclosure Program deadline of March 22, 2024. The agency warns of 7 common signs that their claims may be incorrect.

The IRS intends to release proposed regulations on the PIN requirement for the energy efficiency home improvement credit under section 25C.

Debt modifications that include consent fee payments can create unintended tax consequences.

Debt modifications that include consent fee payments can create unintended tax consequences.

No results found.