Insights

Not everything in the accounting and financial world is black and white. Much is left to interpretation coupled with experience. At KHA, we know our clients value our perspective and guidance. We therefore not only see it as our duty to share regulatory updates, but also our commitment to share our insights on matters that impact you, our clients.

Topic

After selling a business, it is crucial to update your estate plan to align with your new financial situation. This article provides and overview of common strategies to consider.

This article discusses estate planning and tax considerations after the sale of a business interest or other liquidity event, including common strategies to reduce estate tax and meet charitable giving goals.

The Corporate Transparency Act will require most businesses to provide beneficial ownership information to the U.S. Department of Treasury to combat money laundering. Find out who needs to report, what information is required, and when the reports must be submitted.

A proposed update would require disclosing compensation, depreciation and inventory costs within income statement line items.

The IRS has released additional guidance on ERC claims basing credit eligibility on supply chain disruptions. In a Generic Legal Advice Memorandum (GLAM) and IRS Notice, the IRS explores various scenarios and clarifies the requirements for employers to substantiate their claims.

A recent IRS Notice provides essential guidance on required minimum distributions (RMDs) under SECURE 2.0. This article reviews that Notice and provides insights into the updated rules and deadlines for RMDs, helping taxpayers navigate the ever-changing landscape of retirement planning and compliance with IRS regulations.

IRS guidance addresses full or partial suspensions of operations due to supply chain disruption for ERTC and erroneous ERTC refunds.

The Internal Revenue Service (IRS) has released its yearly update to the revenue procedure controlling the implementation of accounting method changes, which may impact many taxpayers. The updated Rev. Proc. 2023-24, includes changes related to depreciation and R&D expenses, among other items.

The IRS and Treasury Department have recently released guidance on the monetizing energy credits for businesses. This guidance provides clarity on the process of claiming and monetizing these credits, which can provide significant financial benefits for companies that invest in renewable energy sources.

IRS and Treasury release guidance regarding the monetization of certain clean energy tax credits through direct pay and transferability

Pass-through entity elections are creating tax planning complexity. This article explains what you need to know and what you should do next.

Learn how Artificial Intelligence is transforming worker productivity and its impact on businesses and the labor market.

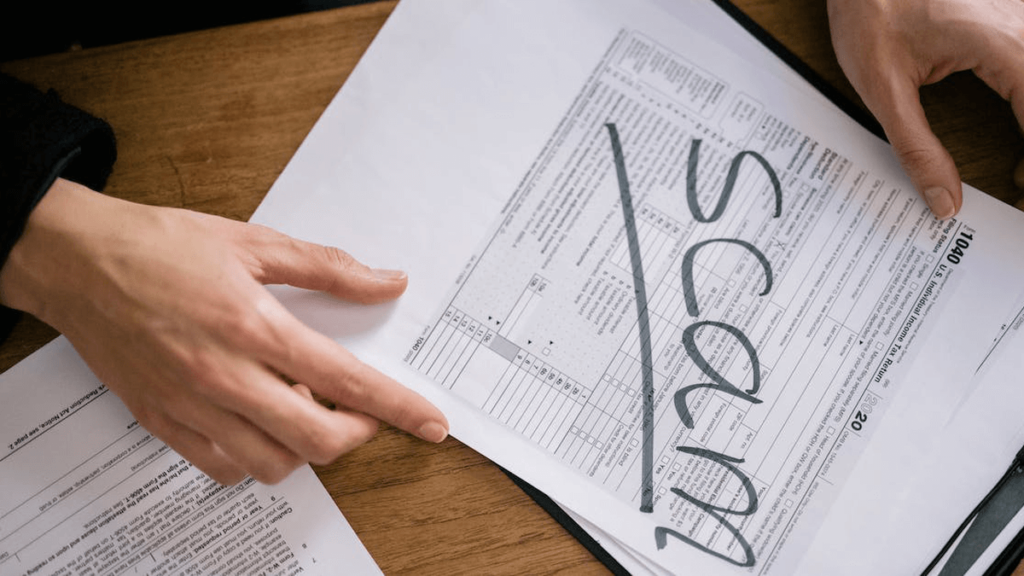

The IRS has released warning signs to identify misleading Employee Retention Credit scams. The release also recommends simple steps for avoiding the filing of a misleading claim.

From financial institutions to car dealerships, MFA is becoming a requirement for companies across industries. This article outlines the expanding use cases for MFA, the different features and functionalities of various MFA solutions, and the need for a holistic security strategy.

Companies should use multifactor authentication as part of a layered security strategy that includes identity and access management which exceeds passwords.

No results found.